Picture this: You’re running a successful digital SEO agency in Belgium, and you’ve just landed three major enterprise clients who need comprehensive SEO visibility across Belgium’s complex market landscape. Your clients’ products are perfect for Belgian consumers, their websites are optimized, but there’s one critical piece missing – they have absolutely no reliable visibility into how they perform across Belgium’s trilingual search ecosystem. Without proper ranking intelligence, they’re essentially operating blind in a €580 billion economy.

This scenario plays out daily across Belgian businesses. In my 15+ years of consulting with enterprises expanding their digital presence across Belgium’s diverse regions, I’ve seen countless companies stumble because they treated multilingual SEO monitoring as a simple checkbox item. Belgium, with its complex trilingual search landscape and sophisticated digital consumer base, demands a level of ranking surveillance that goes far beyond basic position checking.

, mobile vs desktop performance metrics, and competitor analysis charts, set in a modern Belgian corporate office environment with multiple monitors showing Brussels skyline)

Why Belgium’s Search Landscape Demands Enterprise-Level Monitoring

Belgium presents unique challenges that make standard rank tracking inadequate. The country operates with three official languages – Dutch (Flemish), French, and German – each dominating different regions. What ranks #1 in Brussels might not even appear on page one in Antwerp, and that’s before considering the nuanced local search behaviors that vary dramatically between Wallonia and Flanders.

During a recent project I handled for a Ghent-based e-commerce platform targeting nationwide Belgian buyers, we discovered their rankings varied by up to 40 positions between French and Dutch search queries for identical products. Standard consumer-grade rank trackers simply couldn’t capture this complexity, leading to misguided optimization efforts that cost months of potential revenue.

The Belgian market’s sophistication means consumers expect localized, culturally relevant results. A search for “beste smartphone” in Antwerp delivers different results than “meilleur smartphone” in Liège, even when targeting the same products. Enterprise monitoring systems must account for these regional nuances while providing actionable insights for optimization.

Essential Features of Enterprise Belgium Ranking Systems

Multi-Language and Regional Tracking Capabilities

Enterprise-level rank tracking tools provide daily keyword tracking across multiple search engines with localized tracking capabilities, which is crucial for Belgium’s trilingual market. Your monitoring system must track:

- Flemish (Dutch) keywords targeting Brussels, Antwerp, Ghent, and Bruges

- French keywords for Wallonia region including Liège, Namur, and Charleroi

- German keywords for the eastern cantons around Eupen and Sankt Vith

- Regional search variations that affect local business visibility across provinces

Real-Time Algorithm Change Detection

Advanced systems can identify major algorithm changes or ranking fluctuations based on site- and page-specific data. Google’s algorithm updates affect different language versions of search results at varying times, making real-time monitoring essential for enterprise operations.

From my experience working with a Brussels-based fintech company, algorithm updates hit their French pages three days before affecting Dutch results. Without enterprise-level monitoring, they would have missed this critical window to adjust their optimization strategy across their multilingual content.

Advanced SERP Feature Monitoring

Belgium’s search results heavily feature:

- Local pack results for “near me” searches in major cities like Brussels, Antwerp, and Ghent

- Featured snippets in multiple languages with regional preferences

- Shopping results for e-commerce queries with Belgian retailer preferences

- Knowledge panels for brand searches with multilingual information

- Image packs for visual product searches across retail categories

Advanced SERP analysis highlights changes in rankings and featured snippets, providing comprehensive visibility beyond traditional organic rankings.

Top Enterprise Ranking Monitoring Platforms for Belgium

AccuRanker: The Enterprise Heavyweight

AccuRanker is specifically designed for enterprise-level companies with a massive database of 24 billion keywords, while its native Google BigQuery, Databox, and Adobe Analytics integrations centralize business datasets. For Belgian market monitoring, AccuRanker excels with:

Technical Specifications:

- Update frequency: Every 24 hours with on-demand refresh options

- Location precision: City-level targeting for Brussels, Antwerp, Ghent, Liège, and Charleroi

- Language support: Full trilingual capability with regional dialect recognition

- API rate limits: 10,000 calls per hour for enterprise accounts

- Data retention: 5 years of historical ranking data with trend analysis

Belgian Business Advantages:

- Time zone optimization: Reporting schedules aligned with Central European Time

- Currency integration: Native EUR reporting and ROI calculations

- Team collaboration: Multi-user access with role-based permissions suitable for distributed Belgian teams

Semrush Enterprise: The All-in-One Solution

Semrush Enterprise offers workflow automation, report customization, and a single platform for keyword tracking, market analysis, content monitoring, and custom forecasting at scale. Key Belgium-specific features include:

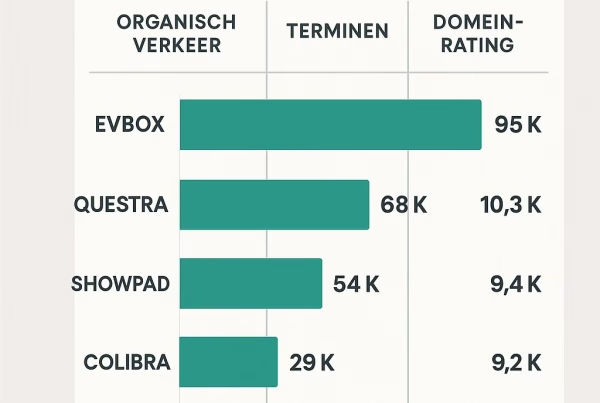

Competitive Intelligence:

- Market share analysis: Track Belgian competitor performance across languages and regions

- Gap analysis: Identify ranking opportunities missed by competitors in specific Belgian markets

- Ad spend intelligence: Monitor Belgian PPC competition and budget allocation across French and Dutch campaigns

Content Performance Tracking:

- Multilingual content analysis: Performance comparison across Dutch, French, German content versions

- Local content trends: Belgian-specific topic and keyword trending data with seasonal patterns

- Content gap identification: Missing content opportunities in Belgian market segments

SE Ranking: The Cost-Effective Enterprise Option

SE Ranking is designed for large companies looking to boost their online marketing efforts with detailed analytics and customizable reporting tools. For budget-conscious Belgian enterprises, SE Ranking offers:

Pricing Advantages:

- Flexible scaling: Pay only for tracked keywords and specific Belgian locations

- White-label options: Custom branding for agency client reporting

- Multi-project management: Separate tracking for different Belgian market segments and client portfolios

Implementation Strategy for Belgian Enterprises

Phase 1: Market Research and Keyword Foundation

Before implementing enterprise monitoring, conduct thorough Belgian market research across all three linguistic regions:

Keyword Research Methodology:

- Primary keyword identification: Core product/service terms in Dutch, French, and German

- Local modifier research: City-specific and regional search patterns across Belgian provinces

- Competitor keyword analysis: Top Belgian competitors’ ranking strategies in each language

- Search volume analysis: Belgian-specific search volumes vs. broader European trends

Time Investment: 2-3 weeks for comprehensive trilingual research Budget Allocation: 15-20% of total SEO budget for initial research phase

Phase 2: Technical Setup and Integration

System Architecture Requirements:

- Server location: EU-based servers for optimal data collection from Belgian IPs

- API integration: Connect with existing Belgian business analytics and CRM systems

- Database optimization: GDPR-compliant data storage and backup systems

- Access controls: Belgian privacy regulation compliant user management

I recently helped a Leuven-based SaaS company set up their Belgian monitoring system. The key was establishing data flows that captured morning search pattern changes before the Belgian workday began. We implemented automated reporting that delivered insights at 8 AM CET, allowing their team to analyze overnight ranking changes and adjust daily optimization priorities.

Phase 3: Monitoring Protocol Development

Daily Monitoring Checklist:

- Ranking position changes: Track movements across all target keywords in three languages

- SERP feature appearances: Monitor featured snippet and local pack inclusions across Belgian cities

- Competitor analysis: Daily competitive position tracking with language-specific insights

- Technical issues: Server response times and crawl error monitoring for Belgian users

Weekly Deep Analysis:

- Trend identification: Weekly ranking trajectory analysis across linguistic regions

- Content performance: Page-level traffic correlation with ranking changes by language

- Market opportunity assessment: New keyword opportunities and seasonal content gaps

Monthly Strategic Review:

- ROI analysis: Ranking improvements correlation with Belgian traffic and conversions

- Competitive landscape changes: New competitors and market shifts across regions

- Algorithm impact assessment: Major ranking changes and their business impact by language

Overcoming Common Belgian Market Challenges

Language Complexity and Regional Preferences

Belgian search behavior varies significantly between regions. Flemish users often prefer Dutch-language results even for international brands, while Wallonian users may accept English content more readily than their northern counterparts. German-speaking users in the eastern cantons represent a smaller but highly engaged segment.

Solution Framework:

- Trilingual content strategy: Develop culturally adapted content for each linguistic region

- Regional user testing: Conduct search behavior analysis in Brussels, Antwerp, Ghent, Liège, and Charleroi

- Cultural adaptation: Modify messaging for Flemish directness vs. Wallonian formality preferences

Technical Infrastructure Considerations

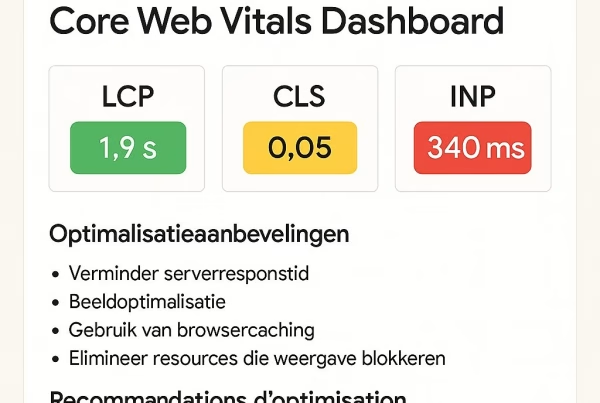

Belgian internet infrastructure is excellent, with average connection speeds of 87 Mbps, but user expectations for site performance are correspondingly high. Page load times above 2.5 seconds significantly impact Belgian rankings, particularly for mobile users who represent 78% of Belgian searches.

Optimization Requirements:

- CDN optimization: European content delivery network deployment with Belgian edge servers

- Mobile performance: Belgium has 84% mobile search penetration with high performance expectations

- Local hosting: Belgian or EU-based hosting for optimal load times and GDPR compliance

GDPR Compliance in Tracking Implementation

Belgian data protection enforcement is particularly strict, with the Data Protection Authority actively monitoring business compliance. Your monitoring system must comply with GDPR requirements while maintaining tracking effectiveness.

Compliance Framework:

- Cookie consent: Implement compliant tracking consent mechanisms for Belgian users

- Data minimization: Collect only necessary ranking and performance data with clear retention policies

- User rights: Establish processes for data access, correction, and deletion requests from Belgian users

ROI Measurement and Business Impact Analysis

Key Performance Indicators for Belgian Market Success

Primary KPIs:

- Organic traffic growth: Belgian traffic increase month-over-month across languages

- Conversion rate optimization: Regional conversion performance analysis

- Market share capture: Rankings for high-commercial-intent keywords in key Belgian cities

Secondary KPIs:

- Brand awareness metrics: Branded search volume growth across Belgian regions

- Content engagement: Time on site and pages per session by linguistic preference

- Social signals: Belgian social media engagement and content sharing patterns

Financial Impact Calculation

For Belgian businesses, calculating SEO ROI requires consideration of regional market penetration rates and multilingual content investment.

ROI Formula for Belgian Multilingual SEO:

Belgian SEO ROI = (Regional Revenue Growth - SEO Investment - Translation Costs) / Total Investment × 100Factors to Include:

- Regional market penetration: Flanders typically requires 4-6 months, Wallonia 6-8 months for significant penetration

- Translation and localization costs: Professional multilingual content development

- Competitive pressure: Higher competition in Brussels and Antwerp markets may require increased investment

Future-Proofing Your Belgian Ranking Strategy

Emerging Trends in Belgian Search

Belgium is at the forefront of several search innovations that will affect ranking strategies:

Voice Search Adoption:

- Smart speaker penetration: 31% of Belgian households use voice assistants with multilingual capabilities

- Multilingual voice queries: Complex language switching within single searches across Dutch, French, and English

- Local business voice search: “Near me” queries in local dialects with high commercial intent

AI-Powered Search Features:

- Google SGE (Search Generative Experience): Early rollout in European markets with multilingual support

- Multilingual AI responses: AI-generated answers across Dutch, French, German with regional context

- Visual search integration: Product discovery through image search with Belgian retailer integration

Technology Integration Roadmap

Next 12 Months:

- Machine learning integration: Automated anomaly detection in trilingual ranking patterns

- Predictive analytics: Forecast ranking changes based on seasonal Belgian market trends

- Advanced automation: Automated reporting and alert systems with language-specific insights

12-24 Months:

- AI-powered insights: Automated optimization recommendations for multilingual content

- Cross-platform integration: Unified tracking across search, social, and paid channels in Belgian markets

- Advanced attribution: Multi-touch attribution for complex Belgian customer journeys across languages

Actionable Implementation Recommendations

Based on my extensive experience helping Belgian enterprises dominate their digital markets, here’s your step-by-step action plan:

Immediate Actions (Next 30 Days)

- Audit current tracking capabilities: Assess gaps in multilingual monitoring setup

- Research Belgian competitors: Identify top 10 competitors across Flemish and Wallonian markets

- Establish baseline measurements: Document current visibility across all three Belgian languages

- Select enterprise monitoring platform: Choose between AccuRanker, Semrush Enterprise, or SE Ranking based on trilingual requirements

Short-term Implementation (30-90 Days)

- Deploy comprehensive keyword tracking: Set up monitoring for 500+ Belgian keywords across Dutch, French, and German

- Establish competitive monitoring: Track top competitors’ performance in Brussels, Antwerp, Ghent, and Liège markets

- Implement automated reporting: Create weekly executive dashboards with trilingual insights and monthly deep-dive reports

- Set up alert systems: Configure immediate notifications for significant ranking changes by language and region

Long-term Optimization (90+ Days)

- Develop predictive models: Use historical data to forecast seasonal Belgian search trends and opportunities

- Expand monitoring scope: Include voice search, image search, and local search monitoring across Belgian cities

- Integrate with business systems: Connect ranking data with CRM and sales analytics for attribution modeling

- Scale monitoring program: Extend insights to inform paid search and social media strategies across Belgian markets

The Belgian market offers tremendous opportunities for businesses willing to invest in proper multilingual search intelligence. The difference between success and failure often comes down to having the right visibility into how your digital presence performs across this complex, trilingual landscape.

Enterprise-level ranking monitoring isn’t just about tracking positions – it’s about building a competitive intelligence system that guides every aspect of your Belgian market strategy. With the right tools, processes, and commitment to data-driven optimization, your business can capture significant market share across Flanders, Wallonia, and the German-speaking communities.

Remember, in Belgium’s competitive digital landscape, the businesses with the best trilingual intelligence win. Don’t let your competitors see opportunities you’re missing across Dutch, French, and German search markets.